How to Write a Check

Do people still write checks? The answer is an absolute yes! Although it is easy to say that people don’t nearly write as many checks as they used to, due to the advancement in technology that has introduced the “card swipe” payment system, checks are still very relevant in today’s business world. The culture of writing checks is still hanging around a bit longer.

With that being the case, if you were to ask a lot of younger individuals, you might be surprised to know that they don’t know how to write a check anymore. Some will even tell you they don’t know what a personal check looks like. That’s not good because it is still widely accepted in financial institutions. With that said, what was once common for everyone now has people struggling.

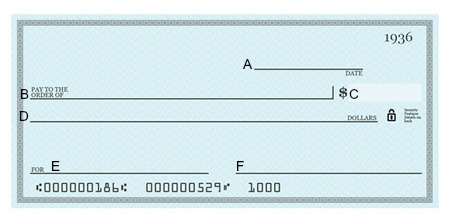

Thankfully, my mother taught me years ago how to write a check. You’re in luck if you don’t know how to write one. Today’s post will show you how to write a check. Below, you will see a sample check.

How To Write a Check

Section A

Write Out The Date Clearly

The date line is at the top of each check. That area is for the date. You must include the month, day, and year. You should put the current date. An example of how the date would look is 10/26/23.

If you want your check to have a more personalized feel, you are equally permitted to write in a Month, Day, and Year format. This means that, unlike the former, you’ll have an opportunity to inscribe the month’s alphabet. An example of this would be “October 26, 2023.”

Writing a date on your check in any of these formats is crucial because it will not be valid without it. So, the next time you have to fill out a check, take your time with this essential step.

Section B

Write The Name Of The Recipient

You will see an area that says pay to the order. In this section, you must write out the payee’s name. Make sure you use the person’s official name. Nicknames or other things should not be written on a check at all. That will invalidate the check, and the bank teller will not cash it.

If you have to write a check for a business, contact the business to see who you need to make your check out. You can write the owner’s name on the check with some companies. While for others, you will have to write it out to the company.

Always address the recipient’s name correctly and let your writing be legible.

Section C

Write The Amount of Money In Numbers

This box is used to write the dollar amount of the check-in numbers. If you are observant enough, you’ll already see that the bank has helped you to indicate the dollar currency sign.

You will need to write out the numerical value. That is to say, if you had an outstanding bill of $500 to pay your trainer, you only need to indicate “500.00” in the check.

Also, use a decimal place to separate dollars and cents. For example, if you are writing a check for $15.95, it would need to look like “15.95.” In this case, 95 is the cent amount.

Section D

Write Out The Amount in Words

In this case, you must write the check amount in words. If you have some cents in your amount, you will put the cents over 100.

Writing the amount this way is like 2-step verification, which is required because our writings are so different. The cashier might not see if you wrote the amount in numbers; they can double-check by reading the amount in words.

This section is located below the recipient line, making it easy to find and fill. A practical example is if you are writing a check for $10.20, it will look like Ten and 20/100 dollars. If there aren’t any cents, you will write 00/100.

Section E

Optional Memo

Next up is the section that is located on the bottom left. This area is for the memo. If you are still trying to decide what to write here, the good news is that it is optional. You don’t have to add anything to the check’s memo line.

If you do, then it is just a note or description of what the check is for. For example, you would put bill payments on the memo line if you are paying a bill. If it’s for rent, you can write a rent check. It doesn’t need to be a paragraph; it just needs to be a short sentence or a few words.

Section F

Append Your Signature

That is the final area of your check. You should sign your name immediately because every check needs to be signed. Sometimes people may need to remember to do it. Without your signature, the check is no good. It can’t be cashed or deposited. You will need to get that check signed by the person who issued it, and if you are the one giving it, sign it.

Numbers at the Bottom

The numbers at the bottom of the check are essential, too. The first nine numbers are the routing number. The routing number is used to identify your bank or credit union. The next group of numbers is your account number. The final numbers are the check number. It can also be found in the top right corner above the date.

There you have it. You now know how to write a check. It wasn’t complicated at all. Even though people don’t write checks as often anymore, you should still know how to do it. Paper checks are still around. People still use personal checks depending on what the situation is. If you decide to write a check, make sure that you check the information and make sure sure that you fill it out correctly. It’s good to know because you may get that one person who still accepts payments via check.

If you write a check, make sure that you balance your checkbook. Also, make sure that you have the funds in your account. If you don’t, you will get a bounced check due to insufficient funds. When a check bounces, it will not process. Also, you may get an overdraft charge. Make sure that you pay attention to your bank account balance.

Jason Butler is the owner of My Money Chronicles, a website where he discusses personal finance, side hustles, travel, and more. Jason is from Atlanta, Georgia. He graduated from Savannah State University with his BA in Marketing. Jason has been featured in Forbes, Discover, and Investopedia.

]

]